File your tax return to Finanzamt via our App

“The hardest thing in the world to understand is the income tax” Einstein once said. But he didn’t know Taxando.

We say – “the easiest thing in the world to understand is income tax”. Simply submit your online tax report to the tax office via Taxando and with the support of a tax advisor.

Live calculator

Find out what you can expect before you file your tax return.

Quick & Hassle-free

With Taxando you only need 15 minutes to prepare your tax return. You save more time for more important things!

Fast electronic tax assessment

You will receive an electronic tax assessment from Taxando and therefore you do not have to wait for the letter from the tax office.

We guarantee security

We're crazy about security. That's why you can sleep peacefully - your data is safe and in good hands.

Let us convince you

We are only satisfied when you are. Still not convinced? Take a free, test drive!

Free trial

You can test Taxando for free. Payment is only required to use the STANDARD or PREMIUM package.

Known from

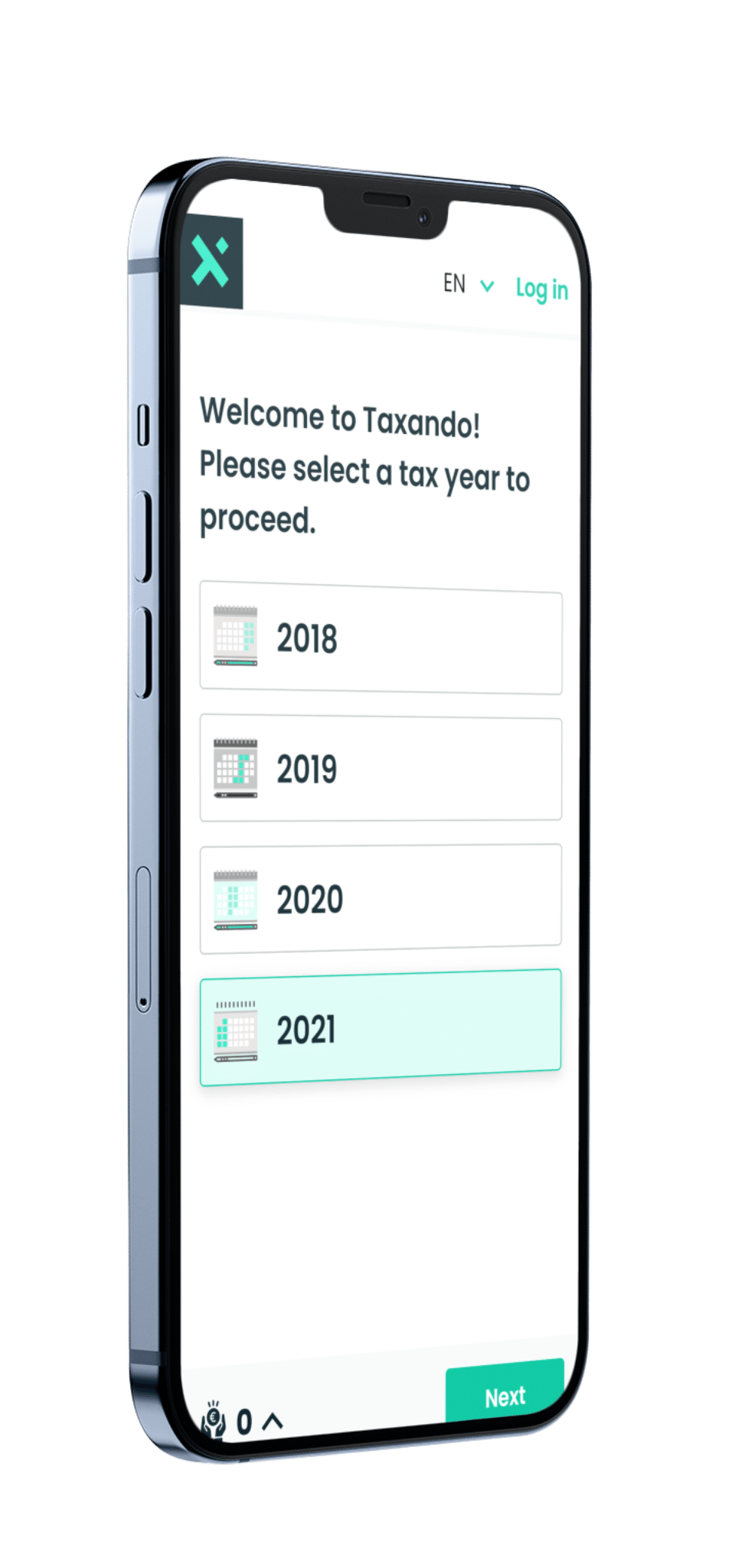

Are you mobile?

So are we: with both iOs and Android Apps. You can also use Taxando with Android Webview.

Instant results: you know where you stand

As soon as you enter your details, Taxando will immediately calculate the estimated tax amount

Keep it simple

Simply upload a photo or PDF of your tax card to the app. Taxando will do the rest for you.

High Ratings & Reviews

Our subscribers give Taxando on average 4.6 out of 5 stars.

1072 EUR in your pocket

By filling out the tax return you can receive an average of EUR 1072 refund

We’re ready to help!

Do you have a technical problem? We respond quickly, and our dedicated advisors handle problems on an individual basis.

The early bird catches the worm!

Your tax return is transmitted electronically via the ELSTER protocol, at the highest level of security to the appropriate tax office. Taxes and software development are our passion … give us a try!

A big plus

for PREMIUM!

Taxando offers an option to prepare your tax return with the assistance of a certified tax advisor — 100% online. Your tax return will be checked for accuracy by officially certified experts. With the support of an advisor, you can often get a larger tax refund and have more time to file your return.

Higher tax refund

Our certified advisors will suggest what deductions you can still use. As a result, you may get a refund increase of up to EUR 980.

You get a guarantee

In the PREMIUM package we guarantee the accurracy of the tax declaration, checked by our officially certified advisors.

Relax!

Taxando's got you covered!

Our adviser takes matters into his own hands and represents you in the event of tax office enquires.

4,6 von 5